- We Are Valley Insurance INC

Burial insurance Plans Made Simple AffordableSecure

Affordable Protection for Your Family’s Future – Peace of Mind Without the Hassle.

Here for You, Every Step of the Way

Plan Ahead, Get Covered Today

Stay Ready for Whatever Life Brings

While the future is uncertain, planning for your final expenses is a vital step in caring for yourself and your loved ones. Though it's a challenging topic, knowing you've secured your family's financial future can bring you peace of mind.

Plan Ahead, Get Covered Today

Your Path to Lasting Peace of Mind

Final expense insurance alleviates the financial burden on your loved ones by covering funeral, burial, and other end-of-life costs. With this coverage, your family can concentrate on what truly matters—honoring your life and mourning your loss. Ensure your loved ones are taken care of and enjoy peace of mind.

Take Action Now!

- Valley Insurance

About Us

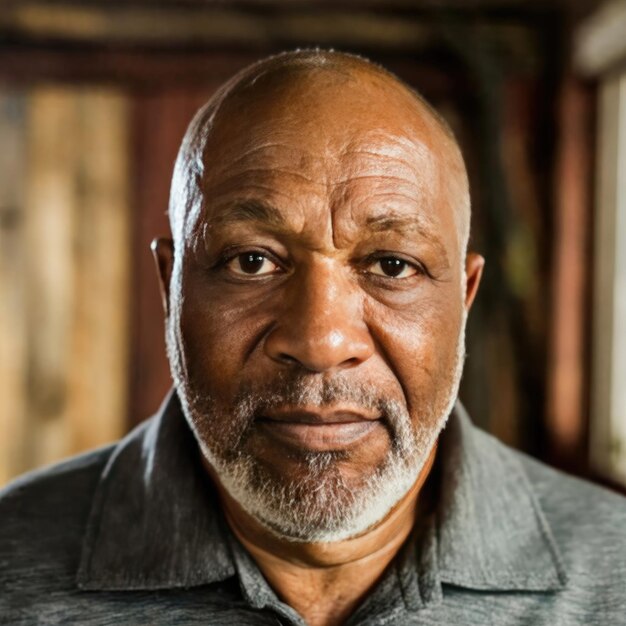

At VALLEY INSURANCE, we focus on families, providing final expense insurance to secure your financial future. With years of experience, we value your hard-earned money and believe in preparing for the unexpected. Our mission is to make insurance accessible, empowering you to protect what matters most during life’s challenges.

You’re not just a policyholder; you’re part of our family. Let us help you secure your loved ones’ future with a final expense plan that delivers peace of mind.

Dedicated, compassionate service

Solutions For Small & Large Business

Guidence From Our Expert Staff

Learn From Customer Feedback

Satisfied Policyholders

Customized Plans Delivered

Families Protected

Industry Awards Won

Plan Ahead, Get Covered Today

Is final expense coverage really necessary?

Absolutely! Even if you have traditional life insurance, your family won't receive your income or benefits when you pass. Having this additional coverage ensures they won’t have to tap into their savings to cover your final expenses.

FAQs

Final expense insurance is a type of life insurance designed to cover end-of-life costs, such as funeral and burial expenses, allowing your loved ones to focus on grieving without the added financial burden.

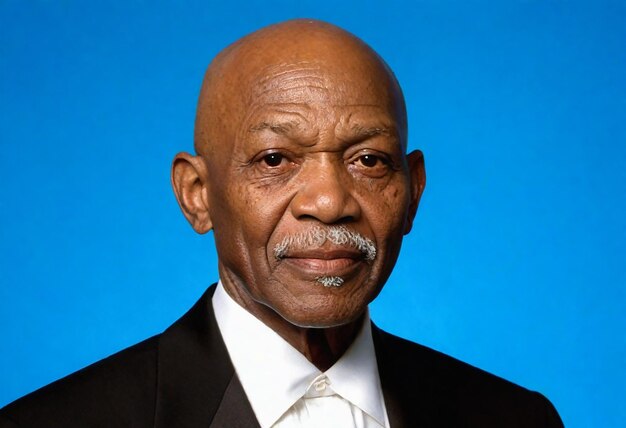

Testimonials

When my father passed away, we were overwhelmed with grief and unexpected expenses. Thanks to VALLEY INSURANCE and our final expense coverage, we honored his wishes without financial stress. It truly gave us peace of mind during a difficult time.